Call Us: 303.993.5271

CEA Leasing Innovations Program

Lease Surna's cultivation equipment and start improving your grows today.

- Home

- >

- Leasing Solutions

Get The Products You Need Through Leasing Innovations

The Leasing Innovations program is designed to provide leasing solutions to Surna’s customers for the complete line of Surna equipment. Upon qualification and acceptance, these options are intended to allow you to conveniently and easily lease your cultivation environment equipment.

The equipment leasing offerings identified under this program are provided exclusively by a third-party leasing company, which has no direct affiliation with Surna. All leasing offers are subject to application and approval by said third-party lease finance company. Surna does not provide financial, tax or accounting advice.

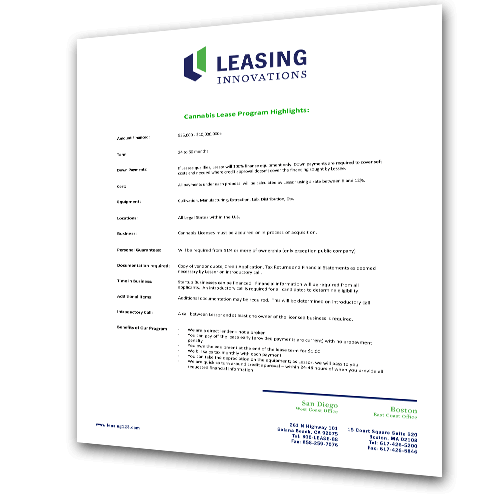

Equipment Leasing Highlights

- Amount Financed: $25,000 – $10,000,000+

- Term: 24 to 60 months

- Down Payments: If Lessee qualifies, Lessor will 100% finance equipment only. Down payments are required to cover soft costs and needed where credit approval doesn’t cover the financing sought by Lessee.

- Cost: All payments under each proposal will be calculated by Lessor using a rate between 6 and 12%.

- Equipment: Cultivation, Manufacturing, Lab, Distribution, Etc.

- Locations: All States within the U.S.

- Business: Licenses must be acquired or in process of acquisition.

- Personal Guarantees: Will be required from 51% or more of ownership, no exception.

- Documentation required: Copy of vendor quote, Credit Application, Tax Returns and Financial Statements as deemed necessary by Lessor on introductory call.

- Time in Business: 2+ years preferred. Startup businesses can be financed.

- Additional Items: Additional documentation may be required. This will be determined on introductory call.

- Introductory Call: A call between Lessor and at least one owner of the licensed business is required.

- Leasing Innovations is a direct lender – not a broker.

- Lessee can pay off the lease early (provided payments are current) with no prepayment penalty.

- Lessee owns the equipment at the end of the lease term for $1.00.

- Lessor will bill sales tax monthly with each payment.

- Lessee can take the depreciation on the equipment; as Lessor will pass depreciation to Lessee.

- Lessor is quick to turn around credit approval – within 24-48 hours of when Lessee provides all requested financial information.

This website and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute finance advisory.

Contact Us

Ready to get started or learn more about how we can help your facility succeed? Fill out the form and a company representative will be in touch.